Here we are nearly post-pandemic, and people still are throwing around the term “new normal.” But what does that mean to the computer-to-screen (CTS) world? This vague phrase is designed to apply to a variety of situations that we all face in a changing and aggressive business climate. In the U.S. market, the main difference in a “new normal” lies in who is buying CTS equipment.

Before the pandemic shut the world down, shops with at least two automatic presses were buying Spyder CTS machines. They were running 35-50 frames a day and could justify an 18-month return on investment (ROI) on the equipment cost. Then, the pandemic forced many shops to lay off their employees as business came to a halt. Fast-forward to mid-summer last year when everything started coming back—the schools, marathons, fundraisers, events, local businesses needing uniforms, etc. When many shop owners called their employees back after being laid off, several had found other jobs or were living with the help of government subsidies and didn’t want to go back to work. Screen printing shops weren’t immune to the worker shortage.

Now, in the post-pandemic world, the average Spyder CTS customer is doing about 15-20 frames a day and has one automatic press. Interestingly, a good number of mom-and-pop or smaller shops are investing in this technology to address increased labor issues post-crisis. Today, instead of investing in people, smaller businesses are seeing the value and return on putting those costs into buying equipment.

In the European market, rising energy costs are making many shops and factories take a major hit after the pandemic took its toll. Textile screen printers’ annual energy consumption is considerably high compared to other industries. In some U.K. markets, energy costs have even tripled. Though government programs are in place to temporarily help business owners with their energy bills, costs remain a major problem in Europe. This impact is felt to a lesser degree in the U.S., where there is a bit more energy self-sufficiency.

Many shops didn’t make it through COVID-19, while others thrived. Thriving businesses include European-based, fast-fashion brands such as ASOS and Boohoo. The online market remains full of opportunities for savvy and creative apparel decorators. These mail-order fashion brands seemingly went nuts as everyone spent the lockdown shopping on Amazon. They churn out new designs almost daily, and their online stores and websites remain very popular. This instant fashion means new styles come out often, as opposed to the typical spring and winter lines of decades past.

Given all the changes that have taken place post-pandemic, why is now a good time to have CTS equipment in your shop? Of course, it reduces labor costs, but you also get your ROI fairly quickly. Additionally, CTS equipment removes human errors as the process becomes digital; you are digitally registering everything. You’re taking the screen room from a mechanical, human-led process where lots of tasks are hands-on, and you take those elements away with the digitization of that workflow. It also reduces human error in setting up jobs faster. CTS can dramatically influence turnaround times by reducing setups to 10-15 minutes in between jobs.

CTS equipment also improves productivity, eliminates bottlenecks, and is eco-friendly. For instance, take the case of a smaller screen printer who recently bought a Spyder CTS machine. The owner says it’s one of the best investments he’s ever made. His shop only does 10-15 frames a day, but the owner thinks about it by the week, which is about 100. With the CTS, his employee now knocks out those frames on a Monday morning, and the shop doesn’t have to make screens for the rest of the week. This increased efficiency frees the employee up to move on to multi-tasking as a dryer catcher, reclaim screens, or whatever is the best use of his time. It definitely made a positive impact.

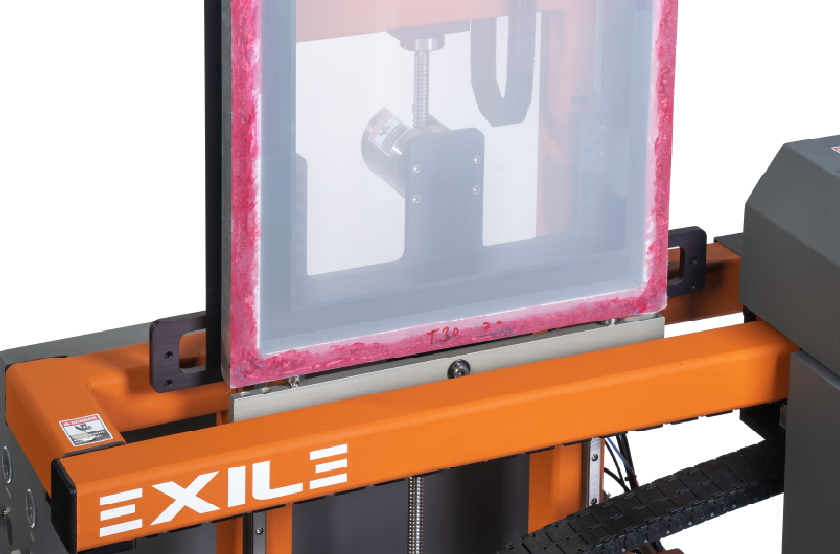

So, how can printers adjust to this new business climate since CTS isn’t just for large shops anymore? More online orders mean shorter runs, and an increased number of shorter runs means bigger profits if you can monopolize your local clientele. Don’t overlook the value of having an online presence because it’s almost like printing on demand, making it worthwhile for smaller shops to invest in automation. Automate other screen room activities first, such as adding an auto-screen coater or LED-based exposure units. Then, take a look at improving your screen room mini workflow. Do this by buying a Spyder CTS machine and turning your exposure unit and auto-developer into an inline system.

Adjusting to a post-pandemic world is challenging but exciting for those looking to expand and be successful in apparel decoration. It just takes smart business savvy, the ability to change the way you’ve always done things, and the willingness to invest in automation to improve workflow and reduce labor costs, as well as be an answer to labor shortages.